The German economy, while still robust, is showing signs of strain. In 2023, the economy contracted by 0.3%, marking the beginning of what is expected to be a challenging economic period. Projections suggest a further contraction of 0.5% in 2024, making it the most severe economic crisis in over two decades for the central European nation.

The ongoing conflict in Europe is exacerbating Germany’s de-industrialization crisis. Unlike the USA, Germany faces fiscal constraints on its ability to support its Eastern European allies financially. Moreover, decades of neglect in military spending have left Germany with limited military equipment to donate to its allies.

Christian Lindner, Germany’s Finance Minister (FDP), in an interview stated that Germans have seen a loss in standard of living as a direct result of the Ukraine conflict. Energy-intensive sectors in Germany are scaling back production due to soaring energy prices, prompting some businesses to relocate to the USA, where industries receive subsidies and tax breaks under the Inflation Reduction Act.

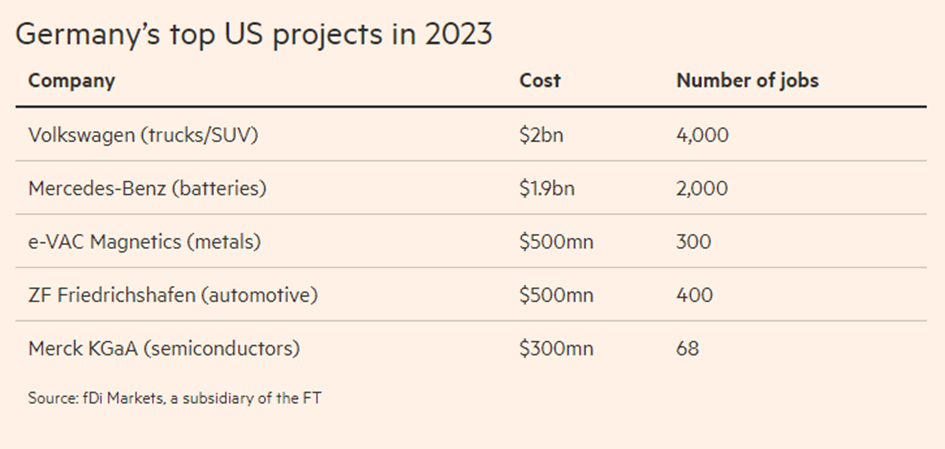

German politicians are frustrated by the USA’s failure to provide financial aid to Ukraine, despite benefiting from Germany’s economic downturn. In 2023, major German companies such as Volkswagen, Mercedes Benz, and ZF Friedrichshafen invested a record $15.7 billion in the USA, up from $8.2 billion from last year. Volkswagen alone created 4,000 jobs in the USA, that could have otherwise been generated in Germany.

The prolonged conflict in Ukraine is driving companies away from Germany’s highly regulated and highly taxed environment. To regain investor confidence, Germany must enhance its attractiveness for investment by reducing regulations, bureaucracy, and offering monetary incentives to energy-intensive industries. While subsidies may provide short-term relief, they are unsustainable in the long run. Germany must also secure reliable energy sources or develop its own supply chains.

More importantly, Germany must also confront some crucial questions. Is an idealistic worldview still viable in today’s geopolitical landscape? Is it economically prudent to continue importing shale gas and oil from the USA at inflated prices, especially when Germany has its own shale reserves? The current policy appears hypocritical at best and economically perilous at worst, driving companies to relocate overseas. Germany should reconsider its approach and consider a more pragmatic approach based on Realpolitik. There are no friends or enemies, there are only national interests.

Picture: Pixabay

Graphic: FT