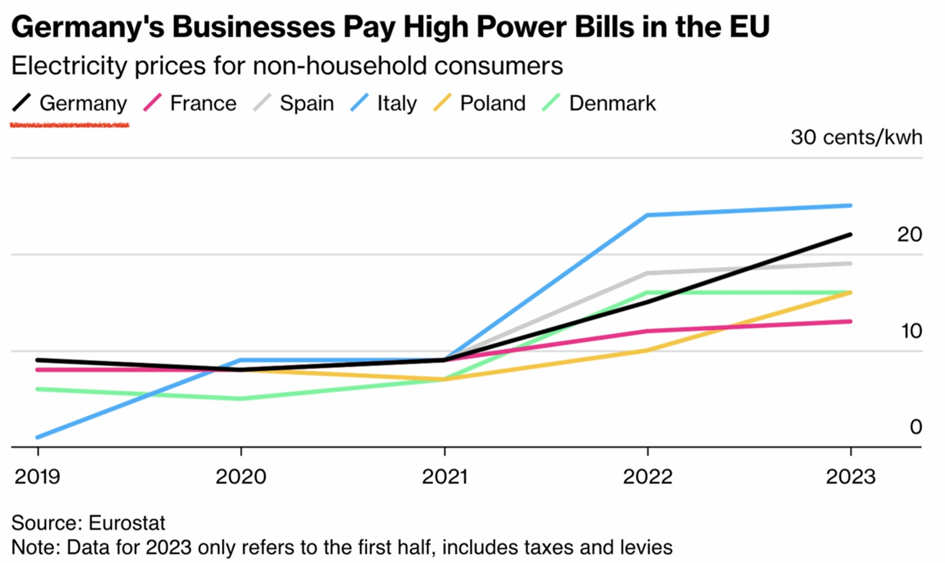

Among the G7 nations, Germany appears to be facing the most significant economic deterioration. The recent contraction in its economy raises concerns about its standing as a global industrial superpower. The pivotal role of energy costs in the German economy is evident, with industries still grappling with the aftermath of the energy crisis that began in 2022. These industries form the backbone of the country’s prosperity, and the surge in energy prices, from 9 cents per kilowatt hour in 2021 to 22 cents in 2023, has resulted in nearly 150% inflation in just two years. The only country with higher energy inflation other than Germany is Italy. The equation is simple – when industries have to pay more for energy, it has an immediate effect on the prices of finished goods, which makes them less competitive in the international but also the domestic market.

The chemical industry stands out as one of the most severely affected sectors, with almost one in ten chemical companies in Germany contemplating the permanent cessation of production processes. This difficult situation has prompted major corporations like BASF to initiate extensive layoffs, displacing thousands of workers and relocating production abroad. Germany finds itself caught in a challenging predicament – its national industries are grappling with an unfavorable economic environment, compounded by the entry of competitively priced Chinese goods into the market. Simultaneously, the USA’s notably generous subsidies for German companies create additional pressures. Given these circumstances, the notable trend of German investments moving overseas comes as no surprise. Input costs in the country are escalating rapidly, and there is a growing trend of increased regulations across Europe. The farmers’ protest serves as a poignant illustration of the clash between «climate warriors» and the practical concerns of the real economy.

In a survey conducted by the Federation of German Industries, companies were questioned about the motivations behind relocating their business operations away from the country. 82% cited the primary reason as seeking better energy costs. Additional factors influencing this decision included lower labor costs, a more favorable market environment, and reduced regulatory burdens. Faced with the looming threat of financial collapse, companies feel compelled to undertake relocation as a strategic response. This prevailing trend, coupled with declining sales and profits, further intensifies corporate debt issues, with 15% of German companies now at risk of defaulting on their debt obligations.

Moreover, contemporary European companies find themselves grappling with elevated interest payments. With the US Federal Reserve raising interest rates, the EU follows suit, amplifying the costs associated with defaulting on debt. German companies, however, are encountering a «double whammy.» Not only are loan servicing costs surging, but concurrently, revenues and profits are on a downward trajectory. This dual challenge places German companies in a precarious position, potentially leaving them without sufficient cash reserves to meet their financial obligations.

Throughout the entire Euro Zone, Germany is leading the charts in corporate distress rankings, with nearly 15% of German companies indicating significant financial challenges. Surprisingly, even the UK and France are faring more favorably than their German counterparts. Consequently, a swarm of «financial vultures» is circling around Germany, with foreign financial entities capitalizing on this state of distress. Private equity firms from abroad are converging on Berlin, seizing opportunities to acquire family businesses – the German Mittelstand – at low prices. Simultaneously, foreign lenders are extending high-interest loans to German companies. One can claim, money is still being made in Germany – just not by the Germans themselves, but private companies originating countries such as the USA.

We are seeing the foundation of the German industrial sector gradually eroding. Compounding this challenge, Germany, alongside the rest of Europe, is committing to financing Ukraine’s local economy with $50 billion over a four-year period, at a time when aid from the US is currently held up in Congress. Germany finds itself compelled to not only salvage its own economy but also contribute to the economic stabilization of Ukraine.

Germany still has the opportunity to steer itself out of this crisis, but it necessitates intelligent and strategic investments in infrastructure, alternative energies, and technology research. However, the outcomes of these initiatives will only manifest in the medium to long term. In the short term, Germans must be prepared to endure a temporary dip in their standard of living and purchasing power.

Cover Photo: Pixabay

Graphic: Bloomberg